From numerous factions clashing for dominance in the global tech war, the spotlight shifts to a slightly unusual battleground, one nestled in Europe that influences much of the worldwide semiconductor industry: the Netherlands and ASML.

A Monumental Face-Off: Netherlands vs. China

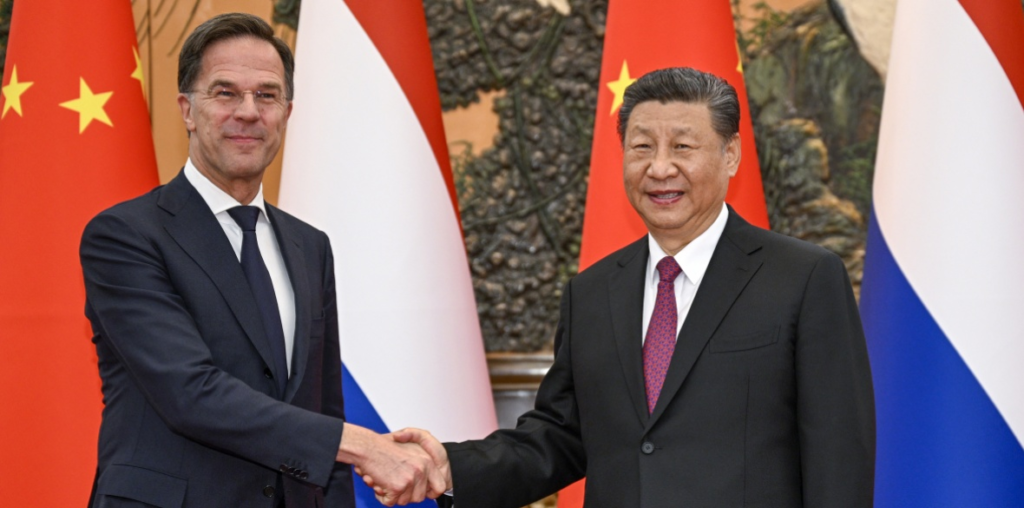

In Beijing, the Dutch Prime minister, Mark Rutte, found himself in a diplomatically tricky position during crucial talks with Chinese President Xi Jinping. The heart of the matter? Chip production technology. Xi Jinping proffered a stern reminder against creating trade barriers, hinting at the jeopardy of leading to a confrontation, and reinforced, “No one can stop China’s progress.”

The thought-provoking question here hinges on the seemingly unexpected Chinese pressure on the Netherlands. The answer lies in the Dutch multinational technology giant, ASML.

ASML’s Dominance in Semiconductor Manufacturing

ASML, domiciled in the Netherlands, furnishes 62% of the ultra-specialized silicon-cutting technology essential for chip production. This advanced Ultraviolet Lithography technology—being mastered by the likes of ASML, Canon, and Nikon—employs precision engineering to slice silicon sheets thinner than a strand of human hair.

Given the Netherlands’ justice-bound association with NATO and the United States’ influence in the treaty, tensions escalated after the US discouraged trade with China regarding chip equipment. In response, the Dutch government enforced licensing controls for selling chip machinery abroad, with several ASML attempts facing denial.

Caught in the crossfire of loyalty and profit, Mark Rutte strikes a balance delicately. His homeland houses ASML, arguably the biggest company in the Netherlands where China is their second-largest market after Taiwan. A veto on sales negatively impacts the company, potentially losing billions. On the flip side, the United States remains their long-standing ally, sharing a potent nuclear connection.

Simultaneously, in the backdrop of the political power vacuum after a conclusive election, Mark Rutte undertakes the caretaker role. His actions are under the stringent observation of NATO allies, ASML, and the global stage.

Potential Impacts, Approaches, and Pulling Strings

China’s President, Xi Jinping, regards the Netherlands and ASML as strategic players in his ambitious quest for China to reign as a chip superpower. His leverage? Bilateral trade, valued at nearly $94 billion, favors China’s exports worth $70 billion, including pivotal electronic items.

While Rutte downplays possible future ripples on overall economic ties with China, assuring a non-targeted policy spanning the semiconductor sector, ASML harbors an unhappy disposition. The company has warned of moving base due to migration laws affecting its sizable migrant talent pool.

Read More:- Australia Fires: A Disaster or Environment Correction!

Conclusion

Mark Rutte’s delicate job of managing alliances, trade, corporate interests, and his political standing dips further into complexity. As a potential successor for the NATO Chief designation, his actions today may echo in eternity, molding the semiconductor industry’s future and predetermining global tech dominance.

Do you like anime? Go to Pop Media Pulse